For example, prepaid casualty insurance has value in that it protects the insured party from having to pay out cash to replace or repair physical assets destroyed or damaged by a calamity. The “value” comes from the asset’s ability to generate a future benefit or stream of benefits. That is, the asset can be used, sold, or collected and thereby bring cash into the firm, or it can be used to avoid cash flowing out. Get instant access to video lessons taught by experienced investment bankers.

Shareholders’ Equity

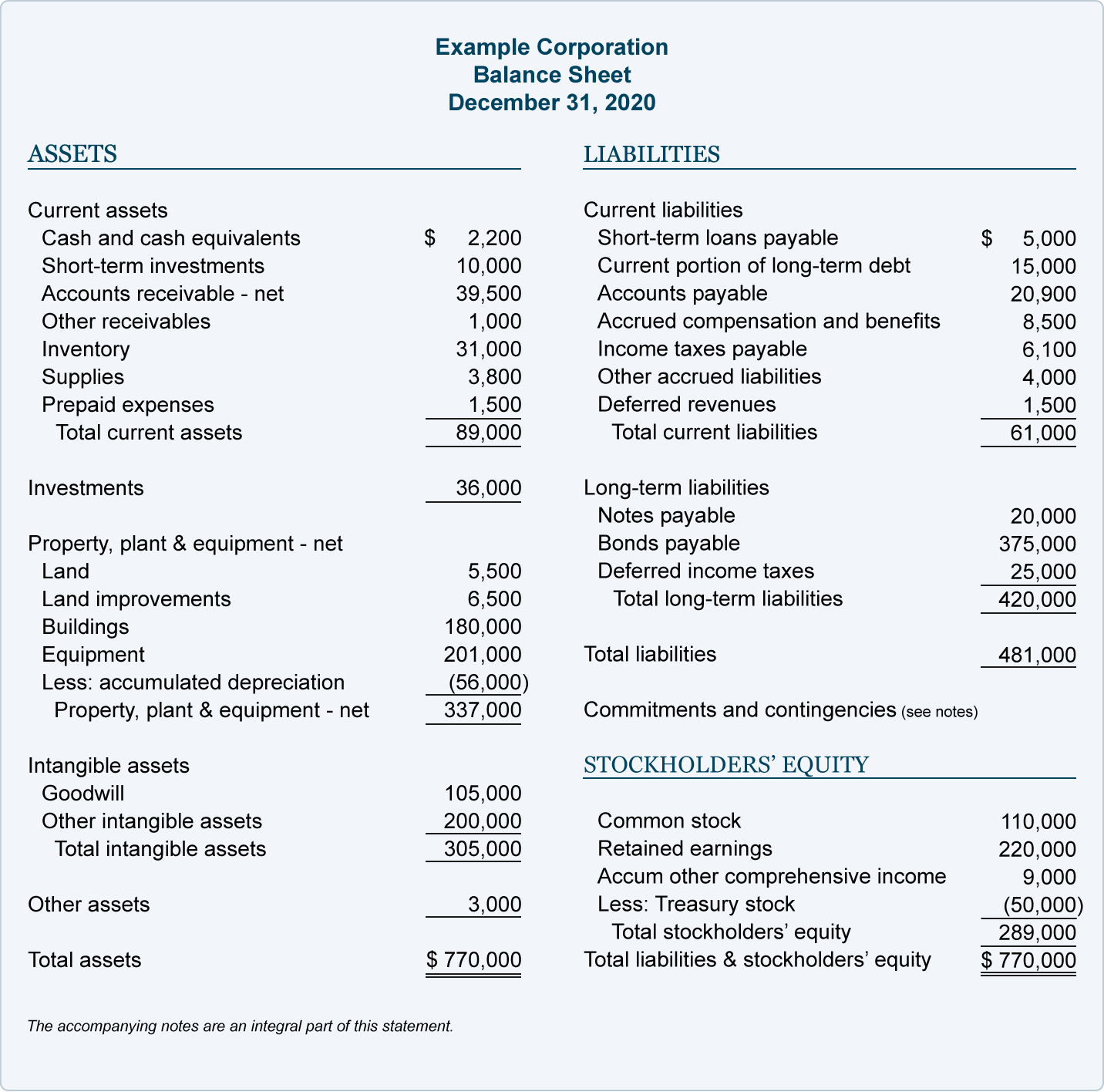

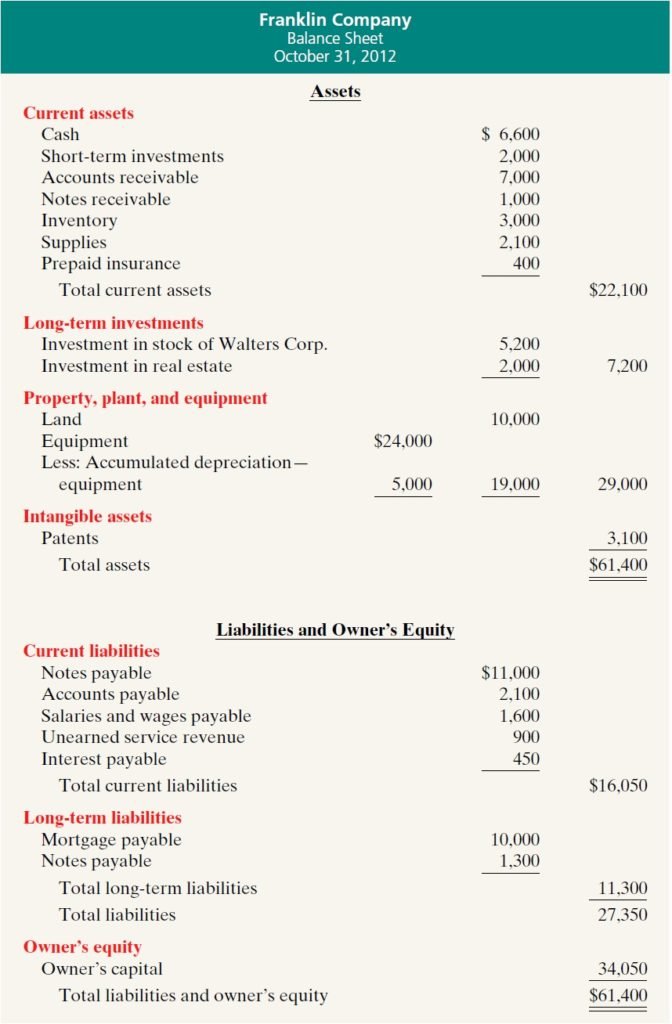

Recall that the income statement shows the performance of a firm over the course of time. The classified balance sheet shows the financial state of a company as of a specific point in time. The classified balance sheet is prepared in sections that align with the accounting equation.

Do you already work with a financial advisor?

Debit amounts are entered on the left side of the “T” and credit amounts are entered on the right side. When the main corporation issues a comparative balance sheet for the entire group of corporations, the balance sheet heading will state “Consolidated Balance Sheets”. A balance sheet must always balance; therefore, this equation should always be true.

Step 3: Identify Your Liabilities

- A balance sheet is one of the primary statements used to determine the net worth of a company and get a quick overview of its financial health.

- You can learn more about inventory and the related cost flows by visiting our topic Inventory and Cost of Goods Sold.

- In these instances, the investor will have to make allowances and/or defer to the experts.

- An income statement, on the other hand, reports revenues and expenses over a longer period.

- The current asset other receivables is the amount other than accounts receivable that a company has a right to receive.

In this section all the resources (i.e., assets) of the business are listed. In the balance sheet, assets having similar characteristics are grouped together. The mostly adopted approach is to divide assets into current assets and non-current assets. Current assets include cash and all assets that can be converted into cash or are expected to be consumed within a short period of time – usually one year. Examples of current assets include cash, cash equivalents, accounts receivable, prepaid expenses, advance payments, short-term investments, and inventories.

These include treasury bills, bank certificates of deposit, commercial paper, banker’s acceptances, and other money market instruments. They are arranged from the most liquid, which is the easiest to convert into cash, into the least liquid, which takes the most time to turn into cash. You can learn more about depreciation expense and accumulated depreciation by visiting our topic Depreciation. The current portion of longer-term borrowing, such as the latest interest payment on a 10-year loan, is also recorded as a current liability. Measuring the owners’ equity using either of the two above approaches has no effect on the outcome. Generally, the creditor would prefer not to take possession of the collateralized asset.

Short-term investments

The term balance sheet refers to a financial statement that reports a company’s assets, liabilities, and shareholder equity at a specific point in time. Balance sheets provide the basis for computing rates of return for investors and evaluating a company’s capital structure. The cash ratio is the most conservative as it considers only cash and cash equivalents. The current ratio is the most accommodating and includes various assets from the Current Assets account. These multiple measures assess the company’s ability to pay outstanding debts and cover liabilities and expenses without liquidating its fixed assets. If current assets are those which can be converted to cash within one year, non-current assets are those which cannot be converted within one year.

You will need to tally up all your assets of the company on the balance sheet as of that date. In the U.S., a company can elect which costs will be removed first from inventory (oldest, most recent, average, or specific cost). During times of inflation or deflation this decision affects both the cost of the inventory reported on the balance sheet and the cost of goods sold reported on the income statement. Generally, sales growth, whether rapid or slow, dictates a larger asset base—higher levels of inventory, receivables, and fixed assets (plant, property, and equipment, or PPE). As a company’s assets grow, its liabilities and/or equity also tend to grow in order for its financial position to stay in balance.

It is helpful for business owners to prepare and review balance sheets in order to assess the financial health of their companies. The data and information included in a balance sheet can sometimes be manipulated by management in order to present a more favorable financial position for the company. It may not provide a full snapshot of the financial health of a company without data from other financial statements.

Fixed or noncurrent assets, on the other hand, are those assets that are not expected to be converted into cash within one year. The sum of current assets and noncurrent assets is the value of a company’s total assets. Although prepaid expenses are not technically liquid, they are listed under current assets irs form 2106 because they free up capital for future use. Investments in common stock, preferred stock, corporate bonds, or government bonds that can be readily sold on a stock or bond exchange. These investments are reported as a current asset if the investor’s intention is to sell the securities within one year.