Did you understand that when trading on Exness, you will have to pay a charge called Exness commission? Do you recognize exactly how to compute the Exness fee payment? Do you know how it affects your trading costs and earnings? In the post, EX Trading will certainly teach you concerning this kind of charge

What is Exness appoint?

Exness payment is a cost that customers pay to Exness when making transactions on specific trading tools. Commission costs are calculated based on trading quantity (lots) and are collected two times: when opening up an order and when closing an order.read about it Exness demo account registration from Our Articles Compensation costs are one of the major sources of earnings for Exness. This is likewise among the crucial elements influencing consumers’ purchase expenses.

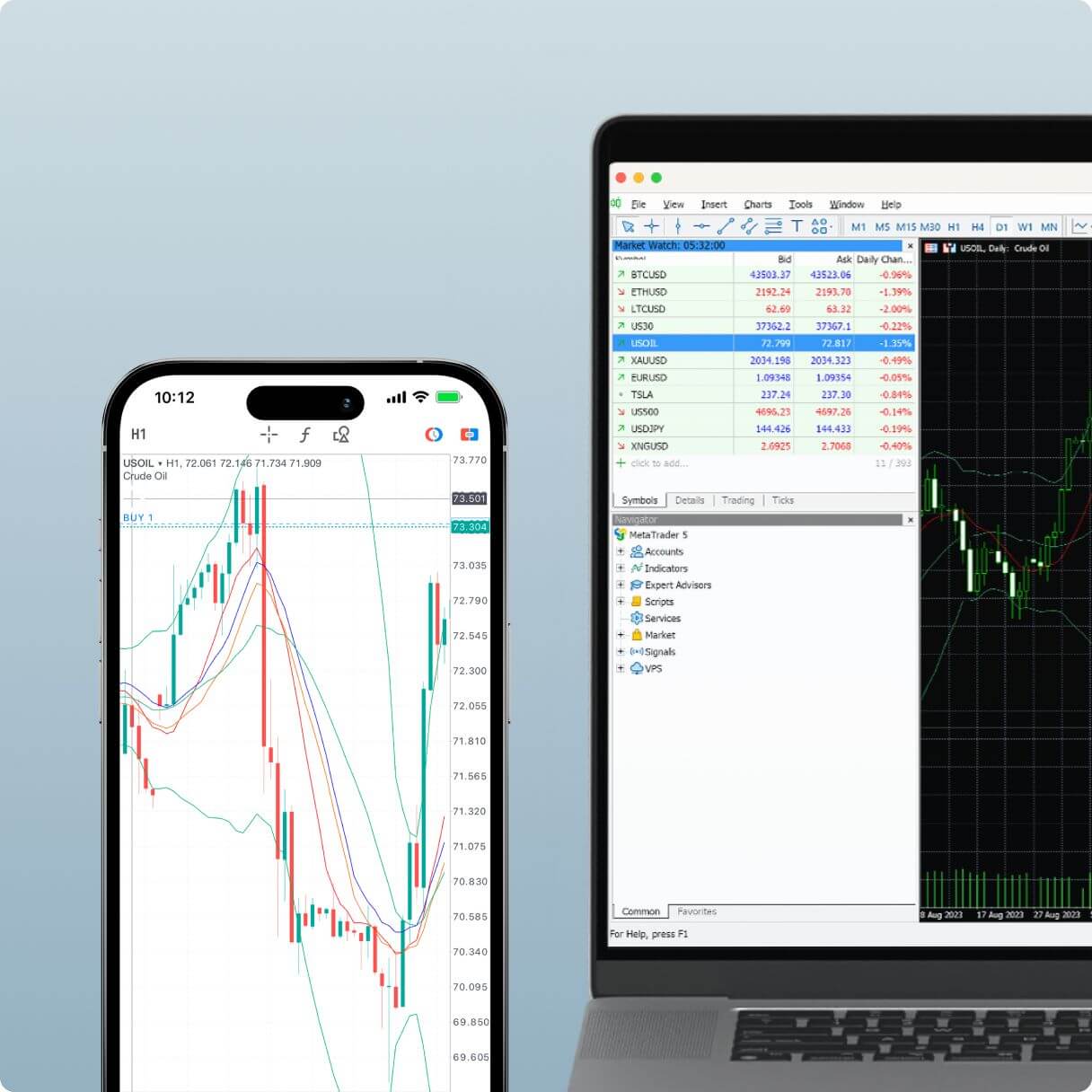

Exness uses several exceptional functions. Diverse deposit and withdrawal techniques such as Exness deposit by means of treasury, visa, skrill, Neteller hellip; The Exness exchange additionally supplies a Social Trading Exness service that allows investors to connect. Along with the above points, the Exness cost payment is additionally a point that brings in the interest of traders. Exness is thought about the very best payment platform worldwide. Compensation charges straight influence traders’ earnings, so Exness has attracted a great deal of traders to participate in trading.

Why are Exness compensation charges various?

Exness commission costs can differ depending on the account type, trading tool, and trading time. According to Business Insider, at Exness the commission that customers need to pay is a minimum of $7 per trading order. Particularly, Exness will certainly collect $3.5 when you open the order, and the continuing to be $3.5 when you close the order.

For instance, if you get 1 great deal of EUR/USD with a commission of $7 per great deal. You will certainly have to pay 3.5$ when opening up an order and 3.5 when shutting an order. In total, you will certainly shed $7 per great deal trading EUR/USD.

Nonetheless, compensation fees can be greater or less than $7 per great deal relying on the trading instrument. Therefore, you ought to examine the contract terms to see details of the compensation costs appropriate per trading tool.

Account kinds for which Exness compensations apply

Not all account types at Exness pay compensation costs. According to the Exness Assistance Facility, the offered account kinds that apply trading commissions are Absolutely no and Raw Spread. Commission-free account kinds are Standard, Requirement Cent, and Pro.

Absolutely no account

Zero account is the account type with the lowest spread at Exness, from just 0 basis points. However, to make up for the reduced spreads, trading commissions begin at $0.20 per whole lot each means. But it can differ depending upon the trading instrument.

For example, when opening up a 1-lot profession order with the GBP/USD instrument, the payment charged will be $ 9 with $4.5 being the compensation for every great deal and one-way profession of this tool on the account. Provision Zero. No compensation is charged when closing a 1-lot profession, as the sum total of $9 will appear when the trade is opened.

Raw Spread Account

Raw Spread accounts are accounts with low but not absolutely no spreads. The ordinary spread of significant currency sets is in between 0.3 and 0.4 basis points. However, to compensate for the reduced spreads, trading compensations are up to $3.50 per whole lot each means for most of trading tools (some indices and cryptocurrencies vary).

For example, when opening up a 1 great deal profession setting with the GBP/USD instrument, the compensation charged will certainly be $ 7 with $3.50 as payment per whole lot and one-way trading for Raw Spread accounts. No compensation is billed when closing a 1-lot profession, as the total of $7 will certainly show up when the profession is opened.

Just how to decrease Exness commission charges

Exness commissions can impact your earnings if you wear’t understand how to decrease them. Here are some means to assist you save money when trading at Exness:

- Pick the account type that matches your trading approach. If you are a short-term investor or scalper. You ought to pick Absolutely no or Raw Spread represent the most affordable spreads. If you are a tool and long-lasting investor or swing trader. You must pick a Criterion, Standard Cent, or Pro account to stay clear of paying payment charges.

- Join the Exness Refund program. A discount is a partial reimbursement of compensation charges to customers when trading. This is a refund program of Exness for customers referred by their IB. A discount is a partial refund of compensation fees to clients when trading. It helps reduce costs and boost earnings. Exness discounts can be up to 90% commission, relying on the account type and trading tool.

- Pick the correct time to trade. Commission costs may rise and fall relying on the moment of trading, because of the impact of variables such as price array, market liquidity, and economic information. Typically, payment fees will be greater during times of strong price variations. Times like when there is important news or when the market opens up and closes.

Instance of cost savings when trading at Exness

If you trade 1 great deal of EUR/USD on a No account with a payment of $9. You will be refunded 90% x $9 = $8.10. So, you only pay $0.90 per whole lot traded. To join Exness’s rebate program, you need to sign up an account with a trusted IB with a high rebate price.

Compare Exness compensation costs with other exchanges

Exness commission costs are among the lowest on the marketplace. Compared to other exchanges such as XM, FBS, HotForex, or FXTM. This fee is also readjusted according to market fluctuations. To make certain that customers constantly get the best trading conditions. Furthermore, Exness additionally has several other advantages such as no deposit/withdrawal costs or monitoring costs.

To contrast compensation fees with other exchanges, you can see the adhering to table. This comparison table will show commissions per whole lot and profession direction for the most popular trading tools on No and Raw Spread account kinds and other exchanges. You can see that Exness payment costs are constantly lower or equal to various other exchanges.

| Trading devices | Exness commission charges | XM compensation charge | FBS commission fees | HotForex compensation costs | FXTM commission charges |

|---|---|---|---|---|---|

| EURUSD | 3.5 USD | 5 USD | 6 USD | 6 USD | 4 USD |

| GBPUSD | 4.5 USD | 6 USD | 9 USD | 9 USD | 6 USD |

| USDJPY | 3.5 USD | 5 USD | 6 USD | 6 USD | 4 USD |

| AUDUSD | 3.5 USD | 5 USD | 6 USD | 6 USD | 4 USD |

| USDCAD | 3.5 USD | 5 USD | 7 USD | 7 USD | 5 USD |

End

Exness payment costs are one of the crucial aspects that influence your trading prices and revenues when trading foreign exchange online. You require to plainly recognize what it is and what types of accounts it puts on in order to pick a trading approach for you. You likewise require to know how to minimize commission charges by picking the best account kind. Please sign up with the refund program and select a practical trading time.

Ideally this write-up has provided you with beneficial details regarding commission charges. If you wish to know more concerning Exness, you can take a look at various other articles on our internet site. Wanting you successful trading!

Frequently asked questions

What is the compensation cost?

- This is a charge that customers should pay to Exness when trading certain tools.

Just how are Exness payment various?

- It can vary depending on the account kind, trading instrument, and trading time. Here the commission fee that consumers need to pay is a minimum of $7 for each and every trading order.

What are the account types that apply to Exness compensation fees?

- Account kinds where compensations use are Absolutely no and Raw Spread. Commission-free account types are Requirement, Requirement Cent, and Pro.

Advantages of Exness

- Year of establishment: 2008

- Permit: FSA, CySEC, FCA, FSC, FSCA, CBCS

- Low compensation charges

- Utilize 1: infinity

- Fastest deposit and withdrawal

What is Exness compensation and why should you care? |